Ready to Scale? A Simple Financial Checklist Before You Hire Your First Employee

The Hidden Costs, Common Disasters, and Path to Peace of Mind When You Make Your First Hire

The moment you're considering hiring your first employee, you've officially moved beyond the startup phase. You're no longer just a dreamer; you're a builder. This is a thrilling milestone, a sign that your hard work, your vision, and your sleepless nights are paying off. You're building a team, creating a brand, and getting ready for the next level of growth.

But as a savvy business owner, you also know that with great opportunity comes great responsibility. That exhilarating feeling is often accompanied by a knot of anxiety in your stomach. What about payroll? What forms do I need? What will this person really cost me? This anxiety is not just in your head. It's rooted in the cold, hard reality that payroll and employee management can be incredibly complex. According to recent surveys, 40% of small business owners cite tax complexity as their biggest challenge, and a large part of that stems from payroll [1]. You didn’t start your business to become a human resources expert or a tax accountant, yet here you are, on the verge of taking on one of the most significant and financially risky decisions of your career.

The good news is that you don't have to navigate this journey alone. This guide is your definitive roadmap to hiring with confidence. We’ll break down every hidden cost, every common mistake, and every smart move you can make to turn your dream of scaling into a secure, profitable reality.

Part 1: The Entrepreneur's Dream vs. The Financial Reality

Many entrepreneurs believe that once they hire their first employee, they’ll instantly get back their time, their business will grow faster, and their life will get easier. While that is the ultimate goal, the journey from "solo-preneur" to "employer" is filled with financial pitfalls. The biggest challenge for a growing business is managing cash flow, and an employee is a significant, recurring expense.

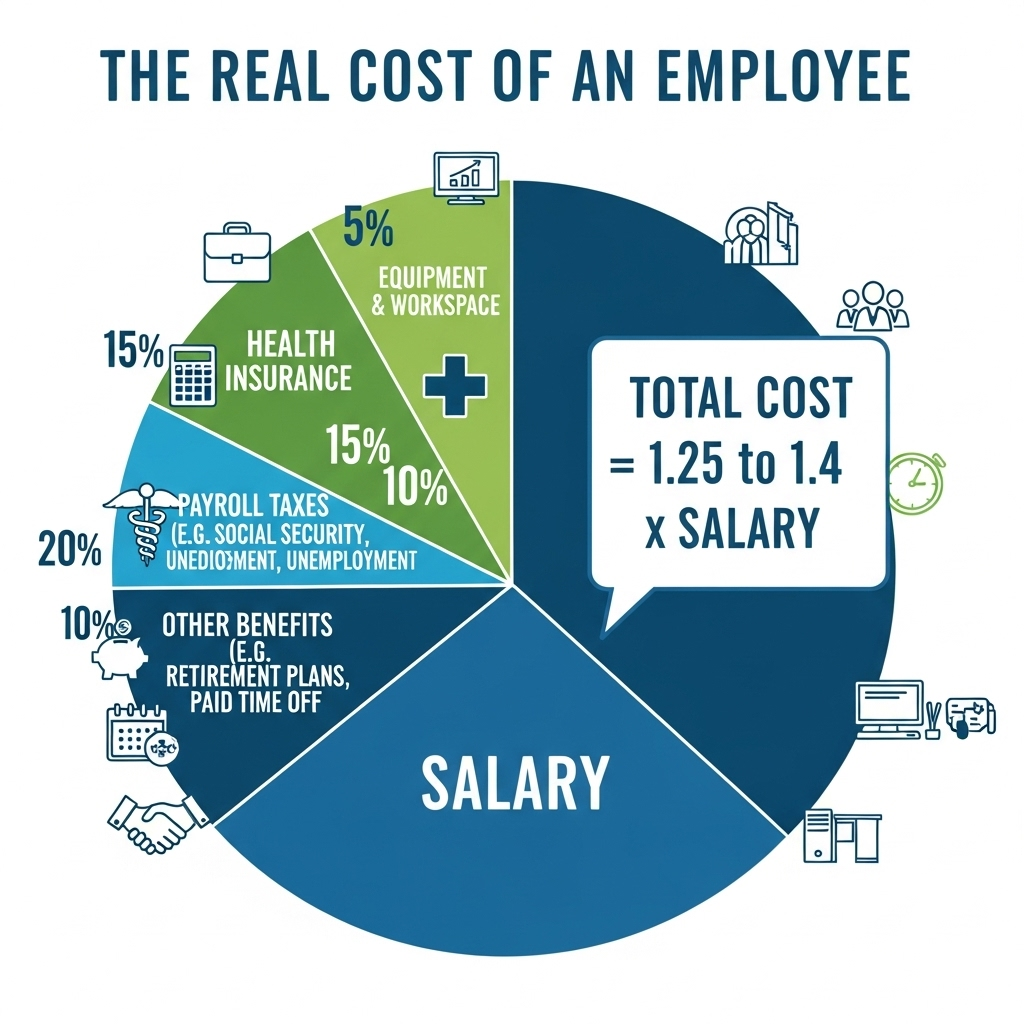

The most common mistake a new business owner makes is assuming an employee's cost is simply their hourly wage or annual salary. This is a dangerous miscalculation that can quickly drain your cash flow and stunt your growth. In reality, the total cost of an employee can be a staggering 1.25 to 1.4 times their base salary when you factor in all the hidden costs [2]. That means a $50,000 salary can actually cost your business up to $70,000.

To truly prepare for your first hire, you must understand these costs in detail.

Part 2: The True Cost of an Employee (Beyond the Paycheck)

You might think an employee's cost is just their salary, but that's only the start. The salary you promise is just a small part of what you will actually pay. In fact, the total cost of an employee can be a staggering 1.25 to 1.4 times their base salary when you factor in all the hidden costs [2]. That means a $50,000 salary can actually cost your business up to $70,000 when you factor in all the hidden costs.

1. Payroll Taxes: The Government's Share

You might think payroll taxes are taken from your employee's paycheck, but a large portion of them are an additional expense that you, the employer, must pay. These mandatory taxes are non-negotiable and include:

- FICA Taxes: This stands for the Federal Insurance Contributions Act and is made up of two parts: Social Security and Medicare. Both you and your employee share this cost.

- Social Security: This tax funds retirement and disability benefits. You must pay 6.2% of your employee's gross wages, up to a certain wage base. Your employee also pays a matching 6.2% that you must withhold from their paycheck.

- Medicare: This tax funds healthcare for the elderly. You must pay 1.45% of your employee's gross wages, with no wage limit. Your employee also pays a matching 1.45%.

- Federal Unemployment Tax (FUTA): This tax funds benefits for workers who have lost their jobs. It is your responsibility as the employer to pay this tax. The tax rate is currently 6.0% on the first $7,000 of each employee's wages, though most employers qualify for a credit that reduces this rate significantly to 0.6% [2].

- State Unemployment Tax (SUTA): Every state has its own unemployment tax, which also varies based on your business’s history and industry. This is another cost you must factor into your budget.

2. Workers' Compensation and Other Insurance

This is not a suggestion—it's a legal requirement in most states. Workers' compensation insurance protects your business if an employee gets hurt on the job. Without it, a single workplace injury could lead to a major lawsuit that could bankrupt your company. The cost of this insurance varies based on your industry's risk level. For example, a landscaping business will likely pay more than a web design firm.

3. Benefits and Perks

To attract top talent, you may need to offer benefits beyond a simple paycheck. These are not required by law, but they are a significant part of your employee's total compensation and can make a big difference in who you hire. These may include:

- Paid Time Off: This includes vacation, sick days, and holidays.

- Health Insurance: If you offer health insurance, you will likely pay a portion of the premium for your employee.

- Retirement Plans: Many companies offer to match employee contributions to a 401(k) or similar retirement plan.

When you add up all these costs, the true financial picture of your first employee becomes clear. Ignoring these expenses is a common reason why promising businesses suddenly run out of cash.

Part 3: The Most Common (and Costly) Payroll Disasters

Knowing your costs is only half the battle. The other half is avoiding the costly mistakes that can result from doing payroll incorrectly.

Mistake 1: Misclassifying Employees (The Most Dangerous Mistake)

This is the single biggest risk a new business owner faces. You might think it is easier and cheaper to pay someone as an independent contractor (a 1099 worker) than as an employee (a W-2 worker) to avoid payroll taxes and paperwork. But the IRS has very strict rules about this.

If the IRS decides that your contractor should have been an employee, you could face massive penalties, including back taxes, interest, and fines. The penalties for misclassifying a worker can be as high as 100% of the FICA taxes owed and $1,000 per misclassified worker [3]. A recent U.S. study found that 10% to 30% of employers have misclassified at least one of their employees, often by mistake [4].

Mistake 2: The "I'll Just Do It Myself" Mistake

You are a master of your craft, whether it's plumbing or web design. But that doesn't mean you're a master of payroll. Manually calculating taxes and making payments is a major source of errors. Research shows that 20% of all payrolls have errors, and it takes an average of $291 to fix each one [4]. These errors can lead to even bigger problems. Missing a tax deadline by just one day can result in a penalty.

Mistake 3: The "I Don't Know My Numbers" Mistake

Without accurate payroll data, you can't truly understand your business. You won't know if your profits are real or if you can afford to grow. This lack of financial clarity is a major reason why 44% of small businesses have problems with cash flow [5]. Payroll is a key part of your business's financial health, and getting it wrong means you're flying blind.

Part 4: The Strategic Hiring Checklist for Success

You can avoid these surprises with a simple plan. Here is a comprehensive financial checklist to complete before you bring on your first employee:

Step 1: The Financial Readiness Check

Before you even start looking for a new hire, you need to make sure your business is financially ready.

- Create a Budget: Determine the full cost of the employee, including salary, taxes, and insurance, and add it to your monthly budget. Make sure you can comfortably afford this for at least six months, even if a slow period hits.

- Set Up a Business Bank Account: This is a non-negotiable first step. It keeps your personal and business finances separate, which is crucial for bookkeeping and tax purposes.

Step 2: Legal & Tax Setup

Once you decide to hire, you must complete the legal paperwork to stay on the right side of the law.

- Obtain an EIN: If you don't have one already, get an Employer Identification Number from the IRS. It's like a Social Security Number for your business.

- Register with Your State: You'll need to register your business with your state's revenue agency to handle state taxes.

- Paperwork: You will need your employee to fill out a W-4 form (for federal tax withholding) and an I-9 form (to prove they can legally work in the U.S.).

Step 3: Choose a Payroll System

You have several options for how to handle payroll. Your choice will depend on your budget and how much time you want to spend on it.

- DIY Payroll Software: These are programs like QuickBooks or Gusto that help you calculate taxes, pay your employees, and file your tax forms. It's a great option if you are comfortable with technology and have the time to learn the system.

- Professional Employer Organization (PEO): A PEO is a company that manages all of your human resources tasks, including payroll, benefits, and compliance. This is a great option for businesses that want a full-service solution.

- Full-Service Payroll Provider: This is a great option for businesses that want a professional to handle their payroll without managing their other HR functions. This is a perfect middle ground for a growing business.

Popular Payroll Service Options

Many of the top payroll providers offer solutions for businesses of all sizes. Here are a few popular services you can choose from:

- Gusto: Known for being very easy to use. It has simple pricing and handles payroll, benefits, and HR in one place.

- ADP: A very big and well-known company. They offer a complete package that handles everything for you, giving you peace of mind.

- Rippling: This is a modern platform that combines payroll with HR, IT, and other employee-related tasks in a single system.

The best choice for your business depends on your specific needs. The most important step is to choose a partner who can help you set up and manage your system correctly so you can avoid mistakes.

Part 5: The Ultimate Solution: Partnering for Peace of Mind

You didn't start a business to become a payroll expert. The best way to use your time is to focus on what you love and what makes you money. Over 70% of small businesses don't have an accountant [6], but those who do gain a significant advantage.

By outsourcing your payroll, you get more than just a service. You get a solution that saves you time, money, and worry.

- Saves Time: You'll get your weekends back. The average small business owner who handles payroll on their own spends 5 to 10 hours a month on it. Imagine what you could do with that extra time!

- Saves Money: A professional can ensure you get every tax benefit you deserve and avoid costly penalties.

- Provides Confidence: You will get accurate reports that tell you exactly what you need to know about your business's finances. This helps you make smart decisions about hiring, growth, and cash flow.

Frequently Asked Questions (FAQ)

What is the biggest payroll mistake small businesses make?

The most common mistakes are misclassifying a worker as a contractor instead of an employee, and missing tax deadlines. These can lead to big fines and legal problems.

Is it better to hire a contractor or an employee?

It depends. Contractors are great for short-term projects. But if you need someone to work for your business every day and you control their work, they should be an employee. Misclassifying them can be a very expensive mistake.

Does my accountant need to know about my payroll?

Yes! It is very important that your accountant knows about your payroll and employees. This helps with tax planning and makes sure your financial statements are correct.

My QuickBooks is a mess. Where should I start?

The best first step is a clean-up. We can go through your old books, fix any errors, and set up your system for the future. You don't have to do it alone.

How much does it cost to outsource my payroll?

The cost varies based on your needs, but it is often less expensive than a single payroll mistake. Think of it as an investment in your peace of mind and business's future.

Can I handle payroll myself with software?

Yes, you can. But remember that you are still responsible for any mistakes. Payroll software can help, but it doesn't replace the knowledge of a professional who can ensure your filings are correct.

Ready to Make the Leap? We'll Handle the Rest.

Hiring your first employee should be exciting, not stressful. By using this checklist, you are taking a smart step toward a more secure and profitable business.

Let us handle the details of payroll services. Our services can make sure you avoid costly mistakes, get back your time, and feel confident in your growth. We can even provide a full bookkeeping cleanup to get your finances in order.

Don't let payroll anxiety hold you back. Your new hire can be a huge step toward reaching your goals, but they need a solid financial foundation. We can provide that, so you can make smart decisions and grow your business with confidence.

Contact Tekkadan Financial Solutions today to talk about your business's next big hire.

Disclaimer: This article is for general information only and does not constitute professional financial or legal advice. You should talk to a qualified professional to discuss your unique situation.

Sources

[1] American University. Research on the small business tax literacy gap.

[2] Homebase. Research on the cost of hiring new employees.

[3] Indeed. Survey on the reasons small businesses outsource their payroll.

[4] OEM America. Studies on the hidden costs and common errors in payroll.

[5] Business Dasher. Statistics on QuickBooks usage and small business accounting.

[6] AdaptCFO. Research on the hidden costs of DIY bookkeeping.